What is Wire Transfer?

What is Wire Transfer?

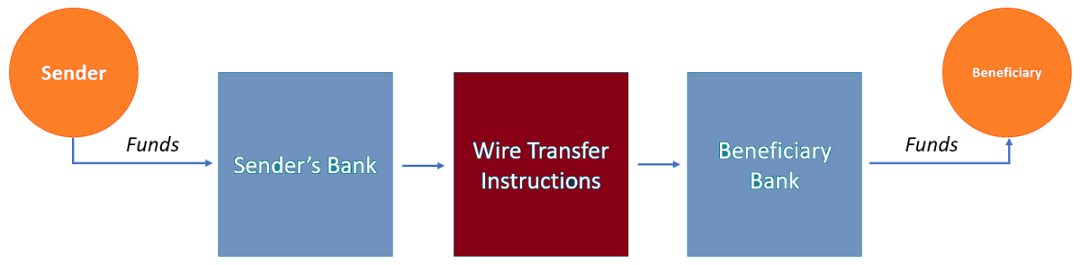

Wire transfer is the electronic transfer of funds between individuals or entities. It permits folks in distant locations around the globe to securely transfer money across geographical locations while not getting in physical contact with one another.

When sending funds via wire transfers, info is passed between 2 banks on the recipient’s identity, their account number, and also the quantity fund that the person is because of receiving.

Wire Transfer

The person initiating the transaction should initial pay a dealings fee before the bank will wire the funds to the opposite party. Once the data is passed to the recipient’s bank, the bank deposits its reserve funds to the recipient’s account, and therefore the 2 establishments settle the payments on the rear finish once the receiver has received the funds. there's no physical exchange of funds.

How will a wire transfer work?

The person or entity wants to create a wire transfer 1st approaches a banking institution and directs them to transfer a selected quantity of money. The sender provides the IBAN and BIC codes of the recipient so that the bank is aware of wherever a fund is to be sent.(ex : Transfer Money to National Australia Bank so National Australia Bank SWIFT code is NATAUS33. )

Before the dealings will be initiated, the sender should deposit funds to be sent and a dealings fee that's determined by the sending bank. The sending bank then transmits a message via a secure system like SWIFT or FedWire to clear the funds.

Once the funds are cleared, the recipient’s bank receives the message requesting it to execute the payment in step with the directions provided. The funds might take many hours or days to get to the recipient’s accounts from the time the sender-initiated the dealings. Either of the banks should hold a reciprocal account with one another to settle the payment.

Uses of wire transfer

The following are a number of the ways in which you'll use wire transfer:

1. To wire fund

2. To receive fund

Types of wire transfers and associated charges

There are 2 forms of wire transfers, i.e., domestic and international. every of those wire transfer types varies in charge and delivery times. Domestic wire transfers get processed among a similar day the wire is sent to the recipient’s bank. Wire transfers among u. s. are charged around $25 per dealings, however, the fee will go as high as $35 looking on the banking establishment.

On the opposite hand, international wire transfers should be cleared by u. s. clearinghouse and a minimum of one foreign country’s process system, that prolongs the time interval to many days. people and entities use this method to transfer massive volumes fund during a foreign currency. For transfer money to domestic level we need Bank ifsc code and for international we need bank SWIFT code / BIC code.

International wire transfers price concerning $43 to send funds from u. s. to a different country. The recipient’s bank deducts about $8 to $10 from the amount of fund wired to the recipient. Some banks could impose some hidden prices higher than the dealings fee that they charge.

PS :

2) Affiliate Payments Top 10 Frequently Asked Questions

4) Best Ways to Send Money Internationally

5) Best ways to send money abroad

6) How to Withdraw Money Through Skrill in Bangladesh

How safe is wire transfer?

There are issues regarding the protection of online fund transfers because of the rising variety of bank fraud cases. Wire transfers are made of one bank to a different, before being deposited within the recipient’s account. in u. s., federal rules need people to verify their identity and supply their physical address so as to open an account and use the wire transfer service. It makes it nearly not possible to transfer funds anonymously and prevents cases of wire transfer scams.

The biggest risk comes in once scammers take hold of another person’s bank account and manage to withdraw money or re-route the funds to a different account. In such situations, account holders are also unable to recover their funds unless they report the cases early enough before the scammers execute their plans.

Additional resources

CFI offers the money Modeling & Valuation Analyst (FMVA)™ certification program for those trying to take their careers to a consecutive level. to stay learning and advancing your career, the subsequent resources are going to be helpful: